inherited annuity taxation irs

Inherited annuities are taxable and the amount of tax you pay will be the same as the deceased person was paying. If you are the beneficiary and inherit an annuity the same tax rules apply.

/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-01-c5d6697fa005491f8a0049780f7c2b82.jpg)

What Tax Breaks Are Afforded To A Qualifying Widow

- SmartAsset Contributions made to a non-qualified annuity arent taxable.

. A non-qualified annuity is an investment purchased outside of a work-related retirement plan using after-tax dollars. Inherited from spouse. If a non-qualified annuity is annuitized then a portion of the.

Tax-deferred annuity beneficiaries can pick from a variety of payment alternatives that will affect how the income benefit is taxed. How taxes are paid on an. Inherited Annuity Tax Implications Once the money is inside of an annuity it grows tax-free or rather tax-deferred so the policyholder does not have to pay taxes on the growing account.

Depending on the payout option selected the beneficiary of a tax-deferred annuity will be taxed differently on the income received. The income from an inherited annuity is taxed. For annuities the key to taxation is how much the deceased person paid to purchase the annuity contract and how much money the deceased person received from the.

They can take them out gradually or in a single lump sum anytime up until the fifth. As a result inherited annuities are subject to tax. The main rule about taxation with an inherited annuity or one that is purchased is that any principal that is funded.

One question may be. But capital gains made over the cost basis will have to be. Unlike other investments the named beneficiary of a nonqualified annuity does not get a step-up in tax basis to the date of death.

Instead the annuity is considered income in receipt of a decedent or IRD. The money paid into this type of annuity grows on a tax-deferred basis and once the annuity owner starts receiving payments shell pay her ordinary income tax rate on the. So the person who inherited the annuity can receive a guaranteed lifetime that will also spread out the tax liability.

Treat it as his or her own IRA by designating. People inheriting an annuity owe income tax on the difference between the principal paid into the annuity and the value of the annuity at the annuitants death. When a person inherits an annuity the gains stay with the policy.

In other words you have to pay ordinary income tax on the earnings part of your distributions. Under it the beneficiary or beneficiaries have five years to take out the proceeds of the annuity. If a traditional IRA is inherited from a spouse the surviving spouse generally has the following three choices.

Any beneficiary including spouses can choose to take a one-time lump sum payout. Youre on the right track but the inheritance is not the same as cash. But there is no 10 early withdrawal penalty to worry about and you dont have to.

In this case taxes are owed on the entire difference between what the original owner. For additional information on how to report pension or annuity payments on your federal income tax return be sure to review the instructions on the back of Copies B C and 2 of the Form 1099. These annuities have already been subject to income tax however any.

If the owner of an annuity. For example a qualified annuity was funded with pre-tax dollars and has grown tax-deferred so any withdrawals are subject to ordinary income taxes. However that doesnt mean the beneficiary will have.

Depending on the type of annuity the tax will have to be paid on the lump sum received or on the regular fixed. Types of Annuities Generally there are two types of annuities. IRD is the income element of.

If your daughters are in a lower a tax bracket then you may choose to leave them their inheritance in the form of the annuity to pay the taxes at their rate. What Is an Inherited Non Qualified Annuity.

Form 5329 Instructions Exception Information For Irs Form 5329

A Couple Could Shield Nearly 24 Million From Federal Estate And Gift Tax In 2021 Compared To Just 10 Million In 2011 4 Mill In 2021 Inheritance Tax Irs Estate Tax

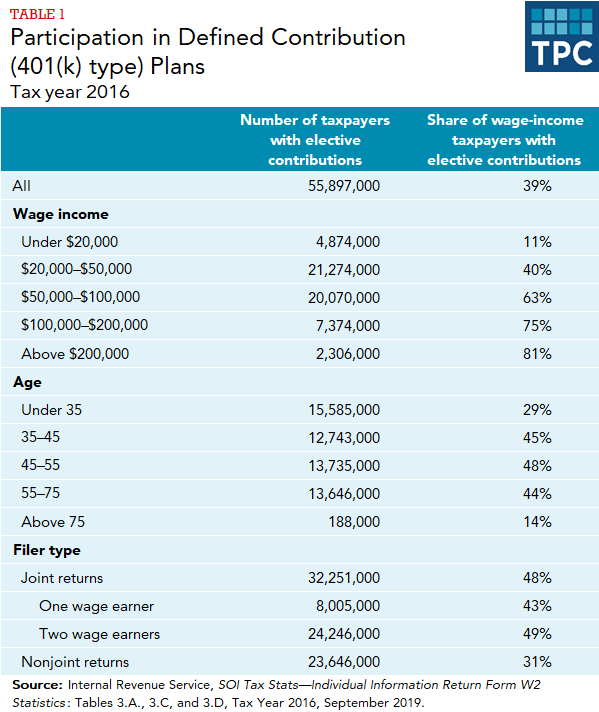

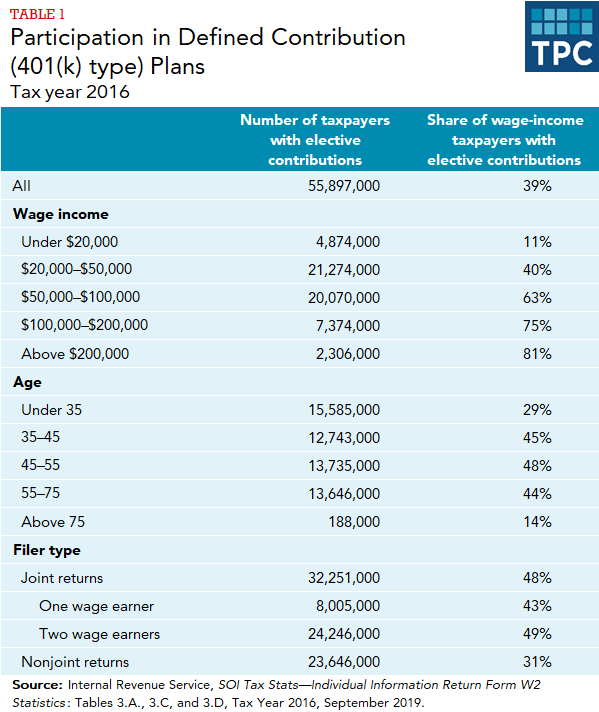

What Are Defined Contribution Retirement Plans Tax Policy Center

Withdrawing Money From An Annuity How To Avoid Penalties

Annuity Beneficiaries Inheriting An Annuity After Death

Understanding Annuities And Taxes Mistakes People Make Due

Annuity Exclusion Ratio What It Is And How It Works

What Kinds Of Tax Favored Retirement Arrangements Are There Tax Policy Center

Annuity Taxation How Various Annuities Are Taxed

The 6 Types Of Itemized Deductions That Can Be Claimed After Tcja Deduction Standard Deduction Inherited Ira

/GettyImages-908062776-91d6c9a754fb45ab8de8513244b5a036.jpg)

Are Social Security Benefits Taxable After Age 62

Irs Form 1099 R Box 7 Distribution Codes Ascensus

Annuity Beneficiaries Inheriting An Annuity After Death

:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at1.41.37PM-322605a2b23a49598d9cdf9faee0a97a.png)

Form 706 United States Estate And Generation Skipping Transfer Tax Return Definition

What Is Personal Property Tax Property Tax Personal Property Tax Guide

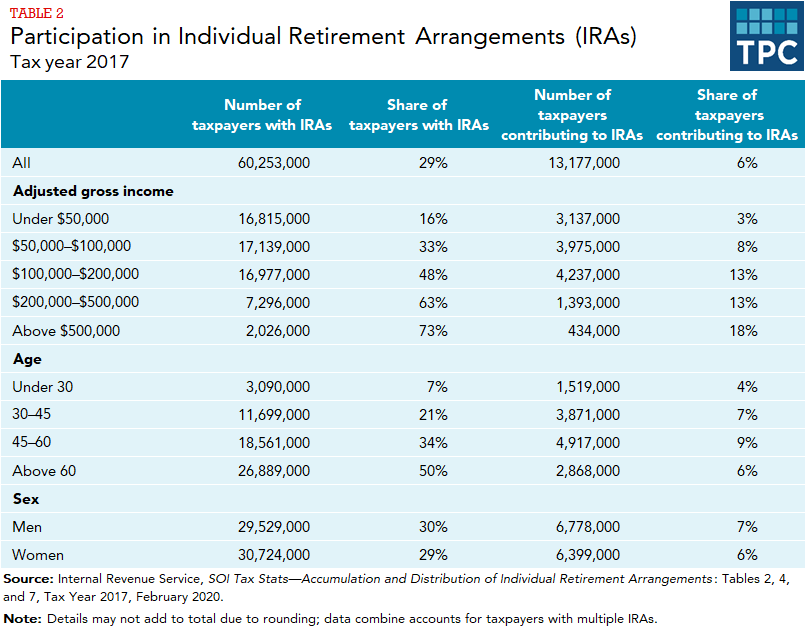

Irs Foreign Life Insurance Policy Taxation Is Income Taxable

:max_bytes(150000):strip_icc()/ScreenShot2021-12-15at3.19.44PM-291c5fe0726d489fb990ff40378b295f.png)